People are looking for you!

Plenty of

investment advice is available today in the form of books, blogs and bhashan for anyone who cares. The space

taken up by the Investment Experts in the media is directly proportional to the

rise in the SENSEX or NIFTY or Dow Jones. Buy this or buy that is the usual

refrain. This is usually the exact time when the retail investor should exit

the market and buy an asset like a car or a house which has some day to day

utility to the person. This is a hypothesis the writer has formed after

observing investment cycles or better said, ‘asset trading cycles’. I shall now

try to convince the reader on the logical basis of this contrarian view.

Basically, whatever the commodity or asset, may be gold or stock, one is

leveraging on a commodity called information. We,

loosely speaking the middle classes, or the salariat,

are at the bottom of the investment pyramid. The information on basis of which

we are to act is second hand or third hand. Naturally the person who gains most

is one who engineers the events. The investment magazines which supply ‘tips’

are back-numbers by the date they are out of the press. Investment is not our

bread and butter, and one just expects to make some good money like the ones

above us in the pyramid have already made, knowing at the back of the mind that

risks are high. In a sense, the Investment Gurus or the brokers or the traders

are like owners of casinos in Las Vegas or today, Bahamas or Manila, and the

retail investor is like the tourist who has to face the Pro~s and should not

mind losing a few hundred dollars. It’s not that they are smarter than us—only

that they are sharks, and basically they are following their dharma! To come back to the contents of the

italicized sentence above, what is implied is that the retail investor exists

at the fag end of the information pyramid, and his entrée is designed to materialize

at a time when the Professionals are all set to offload their stocks and count

their money all the way to the bank, to be kept in the locker, not in an

account!

But

unfortunately, every frenzied investment phase comes to an end in a scam, and

the scam is the result of the greed of the RI, whose appetite has been whetted,

and some unfortunate retail investors end up losing their everything. They are

so to say, ‘left holding the baby’, or in crude Hindi, they are the ones who are

the ultimate topi pehnne waale. In

the following paragraphs, we intend to study various ramifications and

implications of the theory regarding passing on the baby or topi to the RI.

People have

heard the phrase popularized by the late Padma Bhushan Sri. Coimbatore Krishnarao

Prahalad, better known as Prof. C. K. Prahalad,

“fortune at the bottom of the pyramid”. What it means is that the people at the

very bottom of a consumer pyramid far outstrip in numbers the more affluent

people at the top, and when those at the bottom combine, their purchasing power

multiplies to many times of that of the affluent sections at the top of the

pyramid. An example that readily comes to one’s mind is the market for pre-paid

mobile recharges. Kunal Shah, the promoter of the fast growing ‘Firstcharge’

has this to state about the telcom market in India:

98% of the Indian mobile

telephony market is prepaid. As per data, about 15-20 million people recharge

their phones every-day, mostly through offline channels. We sense huge

opportunity here as internet penetration in increasing and about 5% of people

use internet banking for transactional purposes.

That illustration is given only to demonstrate the

immense financial importance of the retail segment, who, individually will be

looked by the affluent sections with disdain, but as a class, command respect

with Marketing Gurus.

Let us now look at the significance and the behaviour of the

class we are labelling ‘retail investor’ here. When a rally starts, to begin

with, it is fragile and unpredictable, but it acquires strength and depth when

retail investors throw in their hats in big numbers. This can be likened to the

arrivals of hundreds of birds to a tree under which the shikari has strewn tasty morsels, and patiently lies in wait for

more and more birds to arrive, so that his chances of a bagging a good quarry

multiply. Let us have a look at something more concrete, the actual numbers.

According to Moneycontrol

estimates, today there are 2.45 crore retail stock-market investors in India. It

is likely that active investors in gold will be much in excess of the number,

and let us assume for the sake of simplicity, that is 5 crores only. Of course

there is lot of overlap.

If half of that number buys only 10 gm. of gold in one

year, the quantity bought will be 250 tonnes, which is approximately 30 % of

the country’s annual gold imports. This is only the spending of the middle

classes and less affluent sections, and shows the power of the people at the

bottom of the pyramid, when they act in consonance. It can therefore safely be

said that retail investors are very important for a rally having depth.

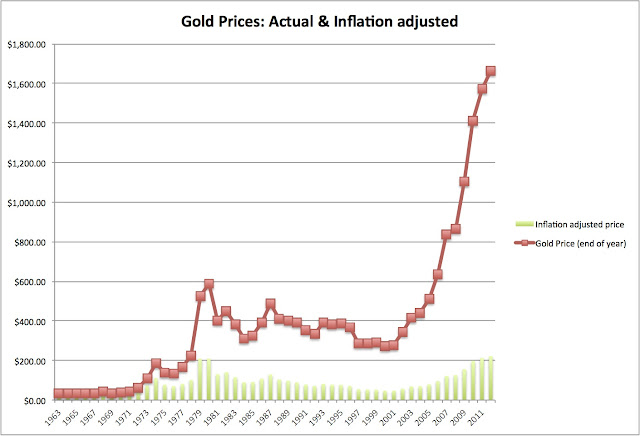

Now see the following graphs of gold prices, nominal and

inflation-adjusted, for 48/49 year-end figures. The graph is available in various

forms on many sites, but this one is crisp and clear, and is taken from A. Damodaran,

who is Professor of Finance in Stern School of Business, New York University.

|

| A PICTURE SAYS AS MUCH AS A 1000 WORDS |

It can be seen that 3 year after the last prominent peak

was achieved by gold in 1980, the nominal prices fell to less than half. Inflation-adjusted

prices have a habit of diving deeper, as per the green bar chart below the line

in the same picture. We were already in the service of the Bank by 1980, and

remember the misery that befell society on account of the fall in gold and

silver, and the frauds that occurred in Banks due to the crash. You will today

find numerous reports of Jewellery frauds in the press.

A similar cycle of retail rush ending in periodic massive

crashes can be seen in the stock market also.

The investors who survive the crash discover that there

is no free lunch, and that the investment in Bank FD is the best combination of

safety and returns, particular in the Indian context where the monetary

authority RBI tries to ensure a post inflation positive return, topped by

instant liquidity. To extend the analogy of the shikari and birds, the stage comes when the shikari fires pellets at the birds, some birds fall prey, and the

rest fly away, vowing never to return to the bloody tree. Fortunately, the

losses are spread over crores of people and society somehow manages to swallow

them.

After a decade, a new and upbeat crop of young people

more affluent then their parents comes

up and the stage is set for the same or some-new-some-old shikaris to attract a fresh crop of birds. And so on,… like the

cycles described in Upanishads.

Similar cycles are noticed in Terrorism (10 year cycles),

and as my friend Raj points out, in the behaviour of young political agitators-

witness student uprisings occurring periodically in our country (Nav Nirman Movement- Gujarat; AASU-

Assam; Jaiprakash Movement- Bihar; Anna Hazare- Delhi, etc., etc…) The lily

white boys join the old gangs and nobody remembers that Lalooji and Mahantoji

used to be anti-corruption activists.

The analogy of birds and shikari is universally applicable and we would only advise

enthusiasts that while investing in the risk-laden assets, it is best to keep

an eye on the finger of the shikari on

the trigger!